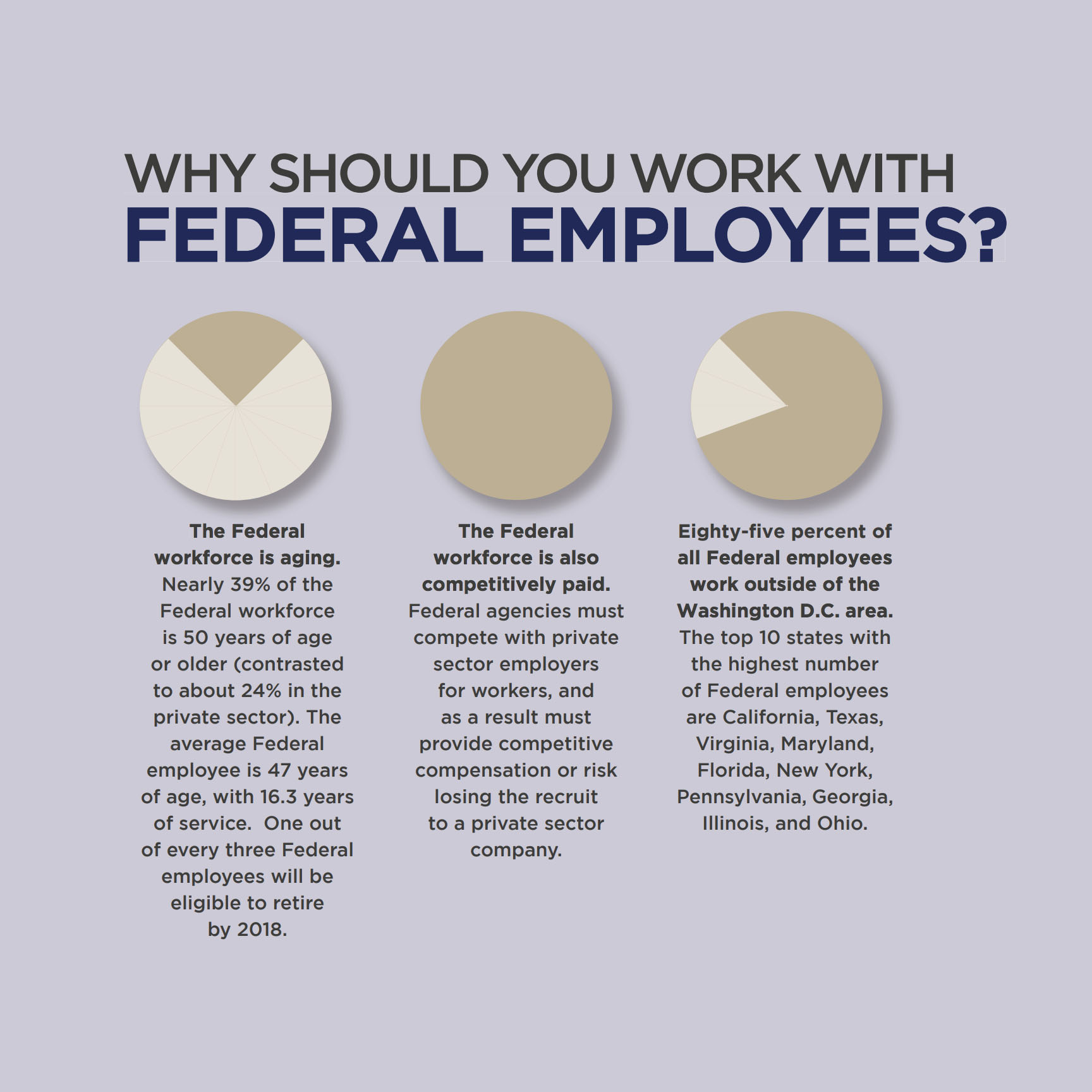

There are Numerous Opportunities with

Federal Employees

Pension Income Alternatives

Maximizing pension income during retirement by choosing the appropriate survivor options and income needs for employees, and benefits options for their survivors.

+ Life Insurance

FERS Employees with Less Than 10 Years of Service

Providing protection for their family in the event of premature death and replacing income if no pension has been earn for the survivors.

+ Life Insurance

Thrift Savings Plan (TSP)

Assistance determining the right fund allocations and reviewing the distribution needs at retirement.

+ Suitable investment needs and distribution options

Federal Employee Group Life Insurance (FEGLI)

Evaluating existing life insurance coverage and costs to protect their family and assets while employed an in retirement.

+ Life Insurance

Voluntary Contribution Plan (VCP)

Utilizing the VCP program benefits and regulations to assist with positioning assets into a Roth IRA based on suitable.

+ Suitable investment needs and distribution options

Disability Coverage

Review existing long-term disability coverage to see if coverage is adequate to protect the employee and their family.

+ Disability or Life Insurance with living benefit riders

Long-Term Care Insurance

Identifying the future potential needs for Long-Term Care and options to cover for the cost.

+ LTC or Life Insurance with living benefit riders